NPV, or Net Present Value, is a fundamental component of financial analysis. It helps determine whether a project will be profitable. The NPV formula is as follows:

NPV = ∑PV – Initial InvestmentThe complete NPV formula becomes:

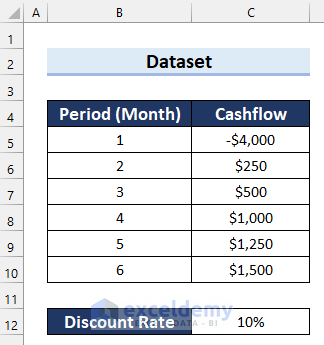

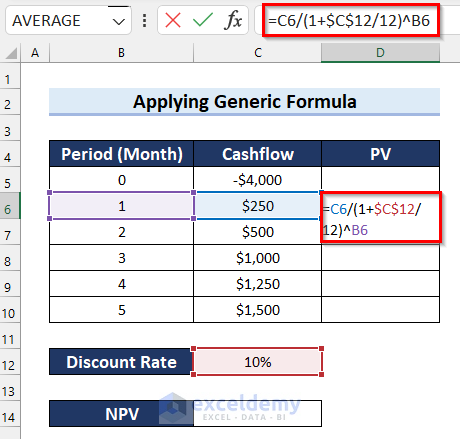

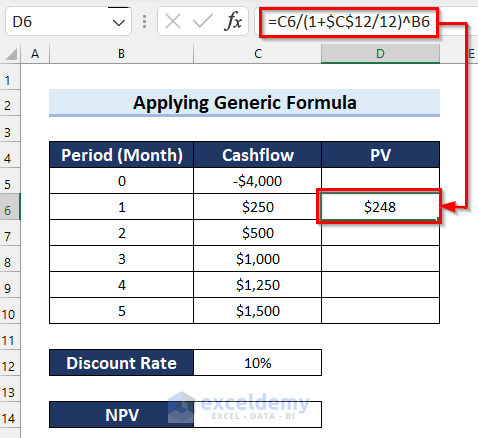

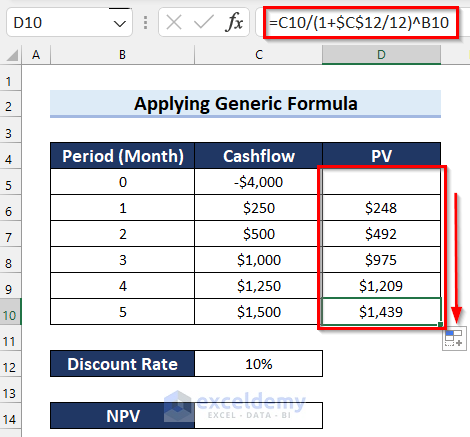

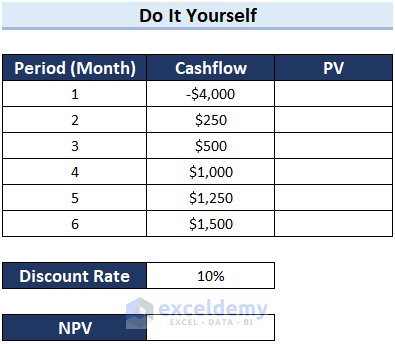

NPV = ∑Cashflow / (1+r) t – Initial InvestmentWe’ll use a dataset containing period, monthly cash flow, and discount rate to demonstrate how to calculate NPV using two different methods in Excel.

In this method, we’ll demonstrate two examples—one when the initial investment occurs after the first month and another when the investment starts at the beginning of the first period.

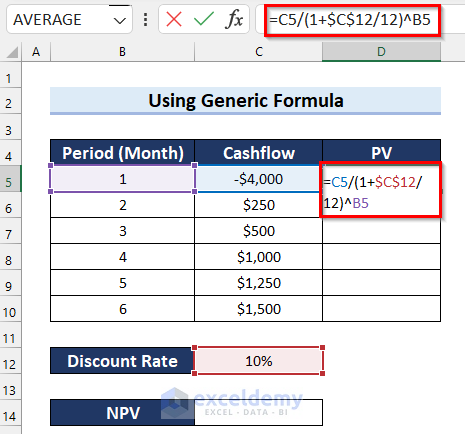

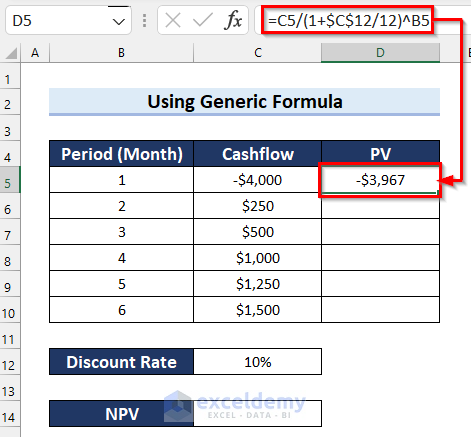

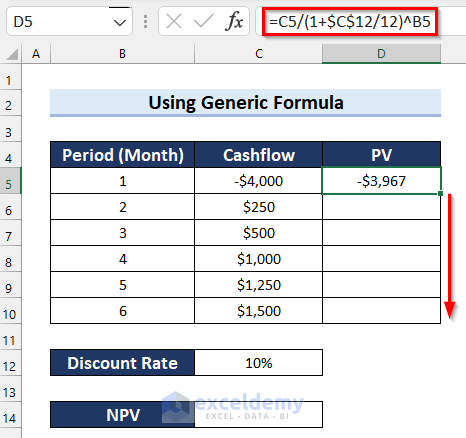

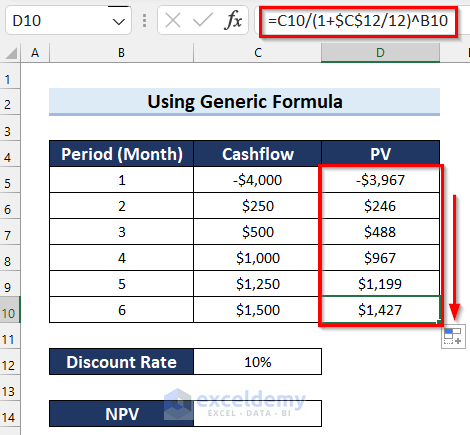

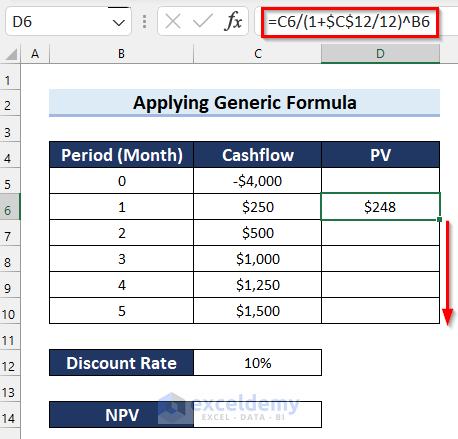

Follow these steps:

Explanation

Note: We used Absolute Cell Reference in the formula so that the formula does not change while using Autofill.

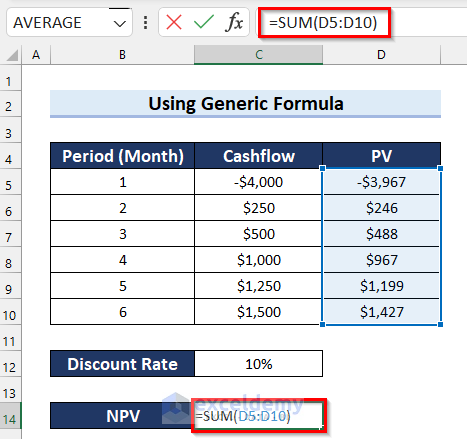

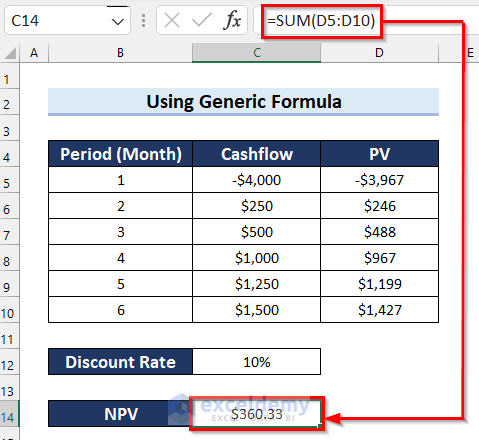

The SUM function adds up the values in the range D5:D10.

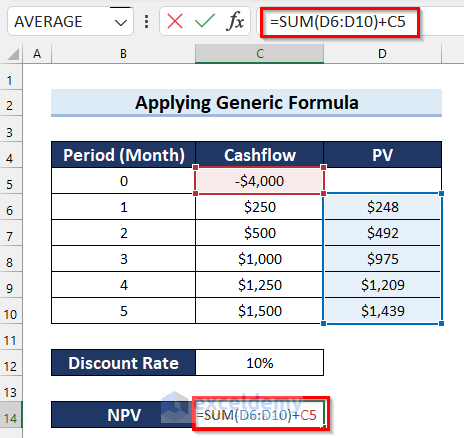

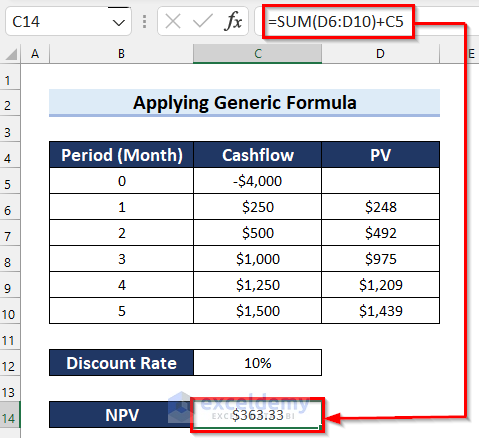

In this example, we’ll determine the Net Present Value (NPV) in Excel when the initial investment occurs at the beginning of the first period.

Follow these steps:

Explanation

The SUM function adds up the values in the cell range D6:D10, and then we add the value in cell C5 to get the NPV.

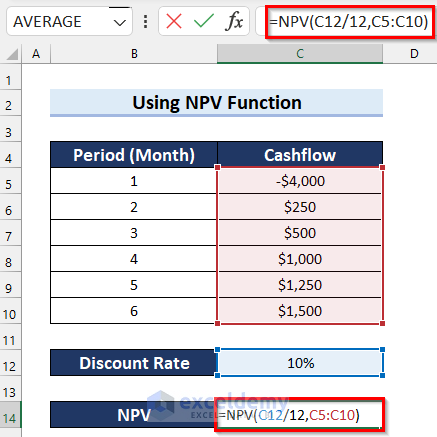

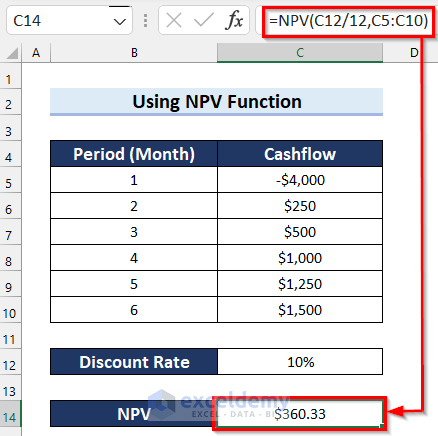

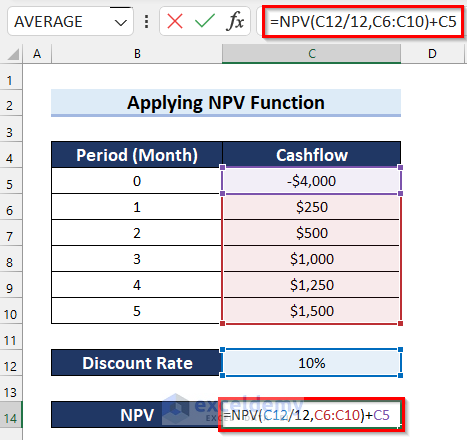

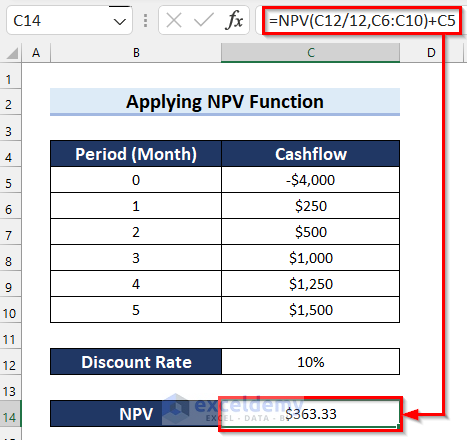

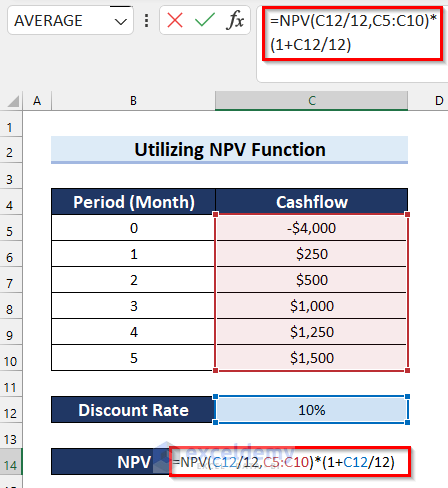

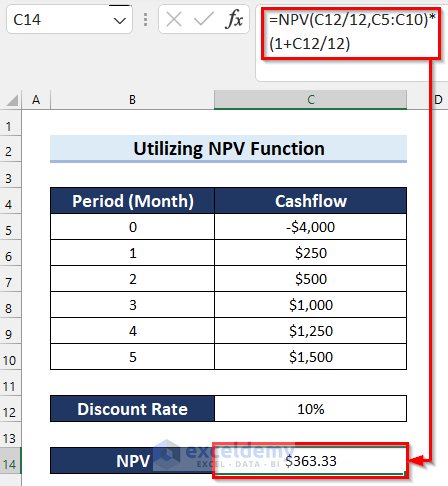

The NPV function in Excel returns the net present value. We will use this function to write an NPV formula for monthly cash flows in Excel. We will demonstrate 3 different examples of using the NPV function in different situations.

Steps

In this formula, we use the monthly rate (C12/12) and the cash flow values in the range C5:C10.

Steps

Explanation

Here, we exclude the initial cost (C5) from the cash flow range and add it back to the NPV result.

Steps

Explanation

This formula includes the initial cost and multiplies the NPV by the factor (1 + C12/12).

Feel free to practice using the provided sheet.

You can download the practice workbook from here:

Mashhura Jahan, BSc in Industrial and Production Engineering from Bangladesh University of Engineering and Technology, invested 1.5 years at ExcelDemy. In roles like Excel & VBA Content Developer, Excel Charts, and Dashboard course trainer, she wrote 90+ articles. She was previously part of the forum support team and a junior software analyst on the Excel Add-in project. With interests spanning Excel, VBA, Power Query, Python, Data Science, and Software Development, Mashhura brings a diverse skill set to her. Read Full Bio

We will be happy to hear your thoughtsExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. We provide tips, how to guide, provide online training, and also provide Excel solutions to your business problems.